Joint with

Certificate OF

Data Integrity

Financial Data Rivers

Financial Data Rivers

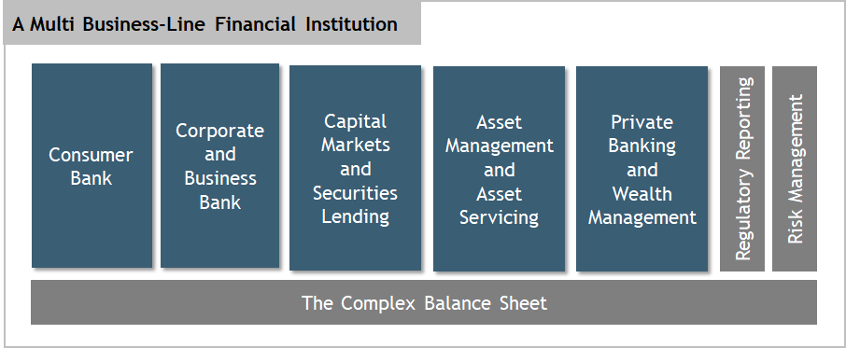

Financial Institutions are organizations that price and manage risk with insights from data to run their businesses. However, driving sound reporting and risk inference data sets is a complicated task, given the complexity of systems and the types of businesses that reside within a Multi-Line Financial Institution

Automating Data Rivers in Financial Institutions is designed to teach a series of building blocks to participants on how to manage disparate data sets.

The course objectives are as follows:

Identification of Data Sources by line of business and asset class

Ingestion of Data Sets into a Data Management Platform

Data Enrichment techniques employed to improve Data Quality

Setting up Data Flows to include aggregations and calculations

The concept of Drill Down to interrogate any sequence of the Data Flow engineered

Auditability of Data Flows using Data Lineage technology

The idea behind Attestation behind an Aggregated Data Set to be used for risk or reporting

The complete program will be created by AxiomSL, GGSJ and MMF, and will consist of three streams

1. A course stream

2. A practical component, which give students the opportunity to see real world examples in a simulated environment

3. An exam, leading to a certification

Upon passing a certification examination, the students will be certified with Data Management Automation credentials, accredited both by AxiomSL and MMF – University of Toronto.

The program contains a substantial practical component, using AxiomSL’s ControllerView Platform to prepare information for risk inference or reporting.

Lecture Schedule

Each Lecture is 90 minutes

Module 1

Lecture 1

Instructor: TBD

Introduction

Course overview, capital markets and the role of regulators

- Syllabus handed out

- High level walkthrough of the capital markets and role of regulators

Module 2

Instructor: TBD

Data Ingestion and Readiness

Lecture 2

Identify data sources within the bank

Wholesale Counterparty Risk

Review data by credit classes – sovereigns, Fis, corporates, funds, small to medium enterprises

Practical exercise:

ControllerView

ControllerView

Native Data Sourcing

Data Souces,

Data wharehouses,

data lakes,

excel files,

csv files

Lecture 3

On reference data

Data Quality and Enrichment

Privacy as applicable to businesses and techniques to mask appropriate information. This section covers the concept of using Reference Data against Ingested Data to develop “Data Fit For Purpose”

Practical exercise:

ControllerView

ControllerView Assignment

Reference Data sources

allowed values using reference data, masking setup review

loader action for controlling values of data loaded

Lecture 4:

ControllerView

ControllerView Lecture

Data Quality

Joins – inner, outer

Data model set up

Data model view

Module 3

Instructor: TBD

Data Flows

Lecture 7

Aggregation of data

Why it is necessary

ControllerView

ControllerView Assignment

Applications

Data interrogation

Application: Counterparty credit reporting for a wholesale bank

Lecture 8

ControllerView Assignment

Case Study

Week 9

Midterm exam

Module 4

Instructor: TBD

Data Lineage

Lecture 10

Audit Defense

Metadata management

ControllerView

Dynamic Data Lineage Technology resident

Lecture 11

Data Lineage

Dependence tracing

ControllerView

Analyze tracer input and find anomalies

Module 5

Instructor: TBD

Data Attestation

Lecture 12

9:00 – 12:00

Automating data rivers

Controls

“fit for use” data to be used in regulatory filings

Risk inference

What type of controls – access, data masking, data entitlements

show trend analysis of the risk calculated – month over month

ControllerView

Data Attestation module

Aggregation of multiple lines of business

Data Sign off

Report

Freezing of data and code

Lecture 13

ControllerView

Regulatory submissions

Operational Elements

Where all the sign-off/data attestation can prove to be useful? What should be the criteria to sign off?

ControllerView

Operational elements of releasing test data for regulatory submissions

Trend Analysis from period-on-period filings

ControllerView Demo

Week 14

Final exam